Continued from the previous post: https://conjyak.com/2025/01/17/did-hashimoto-nanami-of-nogizaka46-and-watanabe-mayu-of-akb48-retire-from-the-entertainment-industry-due-to-sexual-harassment-by-former-johnnys-smap-member-nakai-masahiro/

The January 17, 2025 Fuji TV Press Conference

The press conference on January 17th was led by CEO of Fuji TV Minato Koichi.

Minato apologized for not giving sufficient explanation up to the present.

An internal investigation with an external lawyer was being done by Fuji TV since last year [2024], but in order to investigate whether the company’s actions were proper, a new investigative committee with a third party lawyer as its core has been established.

However, the company also stated that, “We do not believe that this is a third party committee that is in accordance with the guidelines of the Japan Federation of Bar Associations.”

The main controversies of Fuji TV at the moment are:

-Their denial that they had anything to do with the meeting of Nakai Masahiro and the female Fuji TV announcer.

-Their treatment of and internal investigation concerning the incident that the female announcer experienced (the company was aware from June 2023 that there was some issue).

-Whether the practice of Fuji employees setting up private meetings between women [e.g. Fuji TV announcers] and entertainers [e.g. VIPs in show business] is normalized.

Inquiries into these controversies will be entrusted to the new investigative committee.

To any questions about the details of the above issues, Minato refrained from answering and gave as reasons the protection of personal privacy of the people involved and because the details are the subject of the investigation.

NHK and private TV networks are not part of the press clubs (Radio and TV Press Club and Tokyo Broadcast Press Club) of which members were allowed to attend the press conference. NHK asked for permission to record the press conference via video but they were denied. Fuji TV asked that reporting of the press conference begin only after the whole press conference was concluded.

The press clubs are for press that report on radio and TV companies such as newspapers and news agencies, rather than for radio and TV media itself. Thus, no radio or TV media are part of those press clubs. Only after TV networks negotiated with the press clubs were NHK and private TV networks allowed to send an observer to the press conference. However, observers are not allowed to ask questions nor bring a video camera. Fuji TV’s reasoning was that the press conference is a regularly scheduled February press conference by the company that has been pushed forward to January. Video cameras have never been allowed in the regularly scheduled press conferences, and thus that is no different with this press conference.

A professor on media matters, Kageyama Takahiko, states that he found the attitude “backward-looking.” Although the establishment of a third party investigative committee is meritable, it seemed as though protection of privacy and human rights was given as an excuse to withhold information and explanation. He criticized the decision to not open the press conference to all media, especially as Fuji TV is a member of the media itself.

https://www3.nhk.or.jp/news/html/20250117/k10014695441000.html

https://smart-flash.jp/entame/325784/1/1/

Corporate Sponsors Begin to Withdraw

Due to corporate sponsors being unhappy with Fuji TV’s handling of the Nakai Masahiro and female Fuji TV announcer sexual harassment controversies, some of them have begun to withdraw their commercials from Fuji TV shows. The spots are replaced with AC Japan public service announcements.

https://x.com/soonkkkk/status/1880414073281737189

AC Japan (Advertising Council Japan) is a non-profit organization that creates public service announcements on behalf of non-profit organizations. Its advertisements are often aired on TV shows when for some reason, sponsors do not want their advertisements shown on TV.

The Long Play

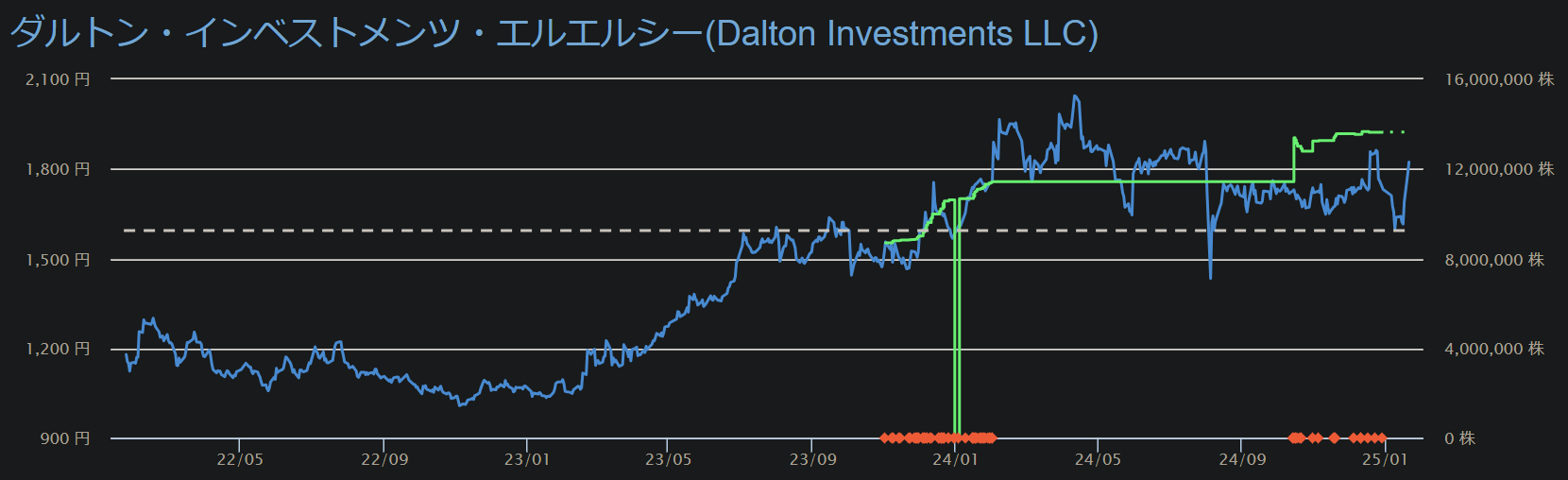

The 7% shareholder of Fuji Media Holdings, Dalton Investments and its affiliate Rising Sun Management, has been critical of the conglomerate nature of Fuji and advocated for breaking up the company. From a Bloomberg article from January 15th 2025:

And from a letter by Dalton Investments and Rising Sun Management from May of 2024, which also notes that Fuji Media Holdings’ (FMH) price-to-book ratio is less than half and calls on the company to spin off a building that the company owns:

Mirror of above pdf letter: Fuji-Media-4th-letter-30May24-signed-black

The Sankei Building is likely part of the book value of Fuji Media Holdings that is helping it to exceed the market capitalization. Shareholders would earn more from selling off the building rather than having Fuji Media Holdings continue to own the property for its business use. In other words, it’s a proposal of a partial (or rather one-part) break up and liquidation of Fuji Media Holdings.

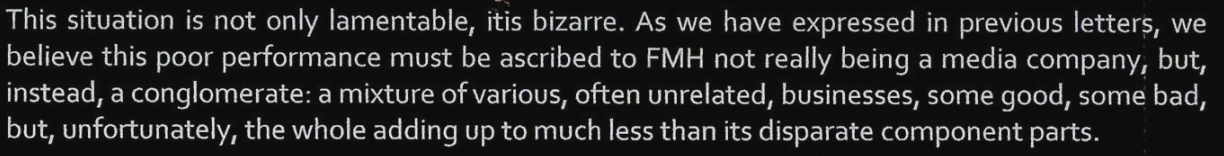

In the most recent letter by Dalton Investments and Rising Sun Management where the main message was the demand for a third party committee to investigate the sexual harassment controversy surrounding Nakai Masahiro and the treatment of Fuji TV female announcers, the conglomerate nature of Fuji Media Holdings was mentioned again in a negative way:

Mirror of above pdf letter: FMH-Special-Independent-Committee-English-PffD-version

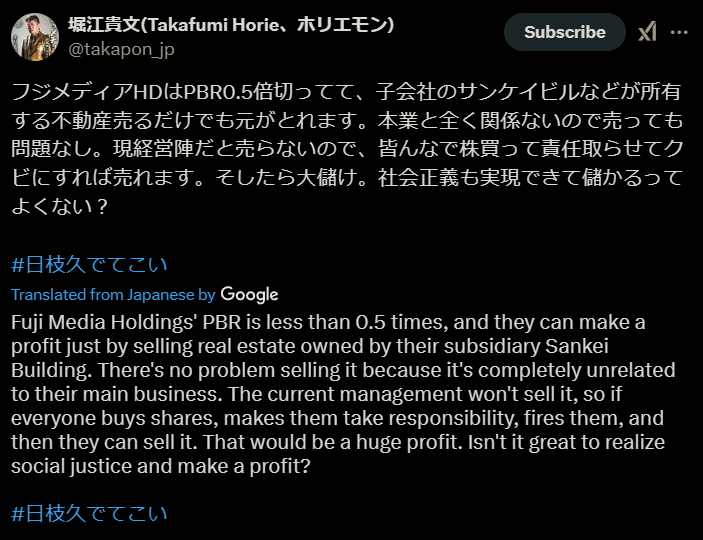

Horie Takafumi brought this to the attention of the Japanese public on January 18th of 2025, also adding that in the case that activist shareholders (in general, not just Dalton Investments and Rising Sun Management) are able to wrest control of the company from the current management in the aftermath of the sexual harassment scandal, even just selling off the Sankei Building would earn all shareholders a profit.

It’s no wonder that Dalton Investments and Rising Sun Management are not afraid of the short or medium term damage to the share price of Fuji Media Holdings that their own call for a third party investigation into the controversy may cause.

The Short Play

While Dalton Investments and Rising Sun Management are major shareholders of Fuji Media Holdings, owning 7%, that alone is not exactly enough to unilaterally enforce decisions upon the company. Can they or other activist investors raise their share of Fuji Media Holdings to, as Google Translate translates Horie Takafumi’s words, “realize social justice and make a profit” at the same time?

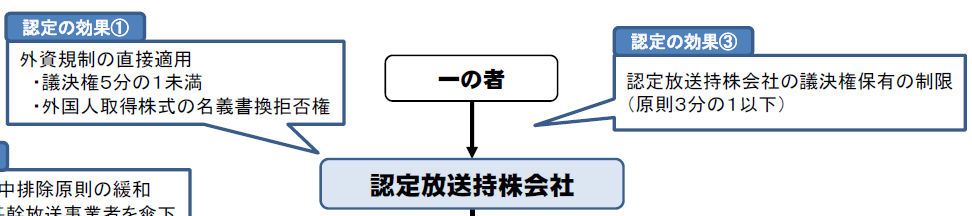

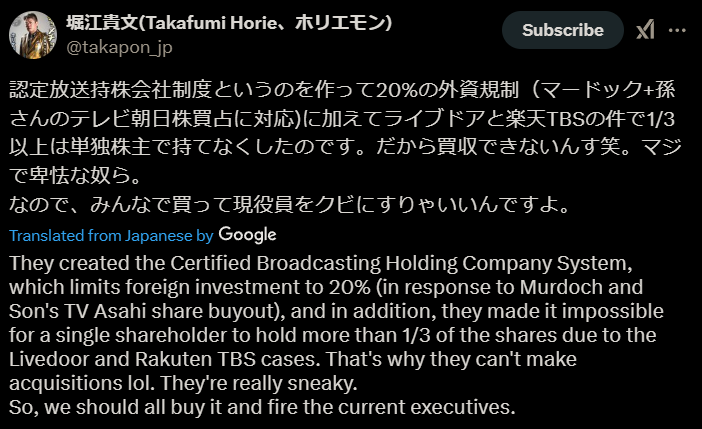

Horie notes that there are roadblocks. Fuji Media Holdings is a Certified Broadcasting Holding Company (認定放送持株会社), Fuji TV is a subsidiary of Fuji Media Holdings, and Dalton Investments and Rising Sun Management are shareholders of Fuji Media Holdings. The regulations regarding Certified Broadcasting Holding Companies state that a shareholder cannot have more than one third of the voting rights for a Certified Broadcasting Holding Company and a Certified Broadcasting Holding Company cannot have more than one fifth of its voting rights be owned by foreign capital.

https://www.soumu.go.jp/main_content/000404701.pdf

If we assume for simplicity that owning Fuji Media Holdings shares means having voting rights that come with those shares, that means that Dalton Investments and Rising Sun Management cannot own more than 20% of Fuji Media Holdings – assuming there are no other foreign shareholders (if there are other foreign shareholders, Dalton Investments and Rising Sun Management can own even less). And even if they find a domestic investor who agrees with their long term plans for Fuji Media Holdings, such a domestic investor on their own cannot own more than 33.3% of Fuji Media Holdings.

This is why Horie Takafumi is making a populist call for people to purchase Fuji Media Holdings shares so that they as a group – if they acquire enough shares – can make changes to the company.

https://x.com/takapon_jp/status/1880905935029493852

If the 93% of shareholders other than Dalton Investments and Rising Sun Management are not willing to go along with the activist investor’s plans, no wonder Minato Koichi and the current Fuji TV management believe that a minimalist response to the call for a third party investigation that they presented at the January 17th press conference may be enough for them to hold on to what they can.

Foreign Ownership of Fuji Media Holdings in a Bit More Detail

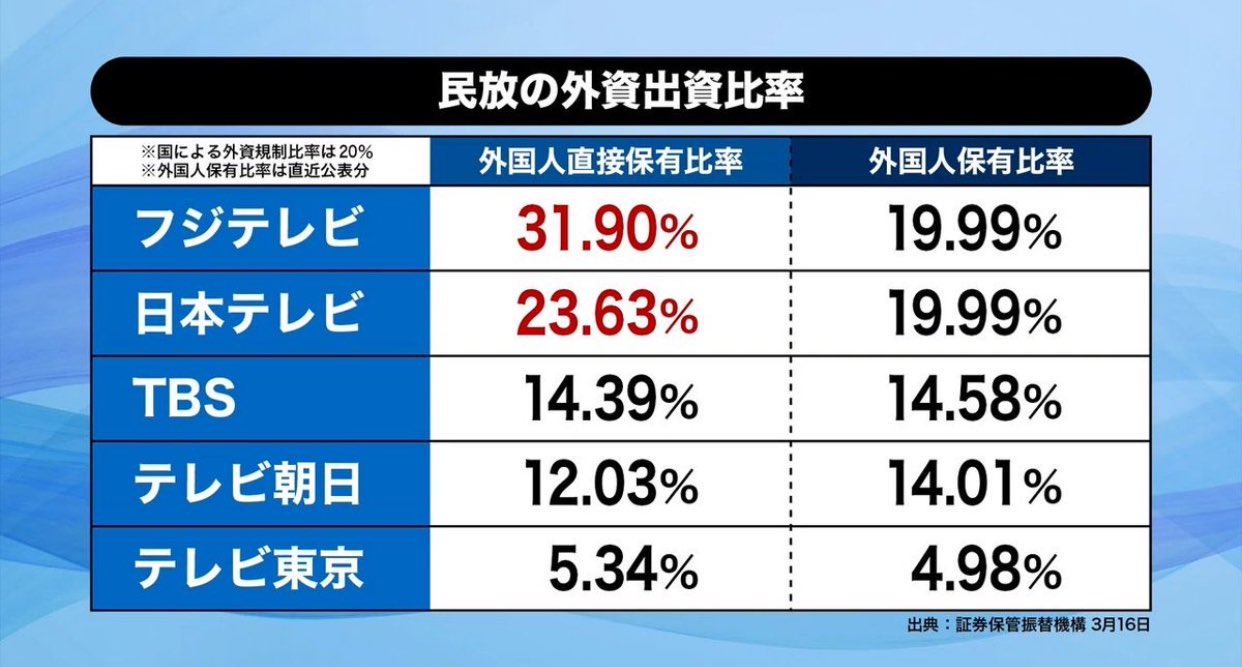

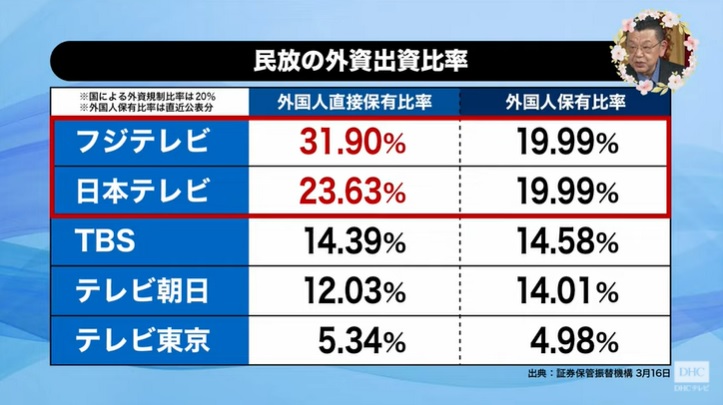

An image of a table showing the foreign ownership shares of Japanese private TV networks (or the holding companies that own the TV networks) is being circulated on X/Twitter:

I’m not exactly sure of the source of this but it seems to be from a show from DHC Television (currently Toranomon Television) from 2021.

https://matomebu.com/news/tv20210323/

https://www.zaikei.co.jp/article/20210324/613531.html

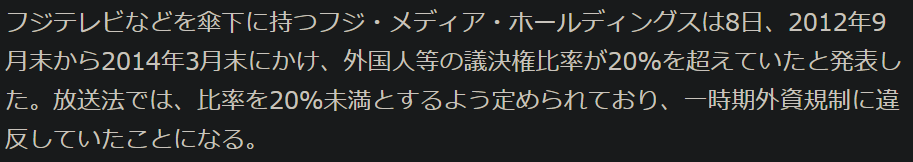

Back in 2021, Fuji TV and Nippon Television were in the news for having their foreign ownership shares be above 20%, seemingly violating regulations. However, as seen in the second column in the image above, which has the largest numbers carefully set to be right under 20%, there’s a technical bit to it. The first column is “Direct holding ratio of FOL by foreigners” where FOL is Foreign Ownership Limitation issues of company shares and the second column is “Foreign Ownership Ratio” (English terms from https://www.jasdec.com/en/description/less/for_pubinfo/for_pubinfo.html). In Japanese, the first column 外国人直接保有比率 can be translated as Foreigner Direct Ownership Ratio and the second column 外国人保有比率 can be translated as Foreigner Ownership Ratio. None of these descriptions explain what is going on.

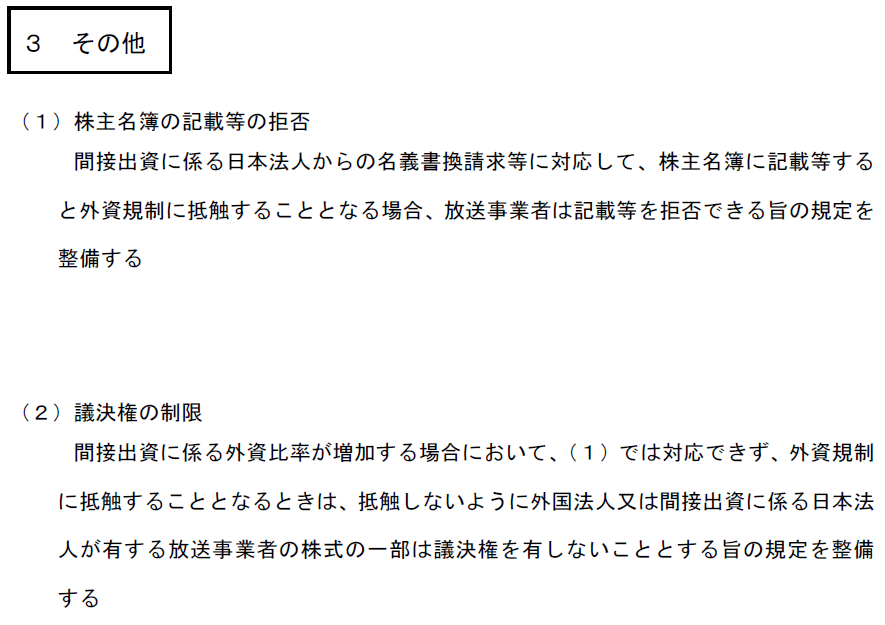

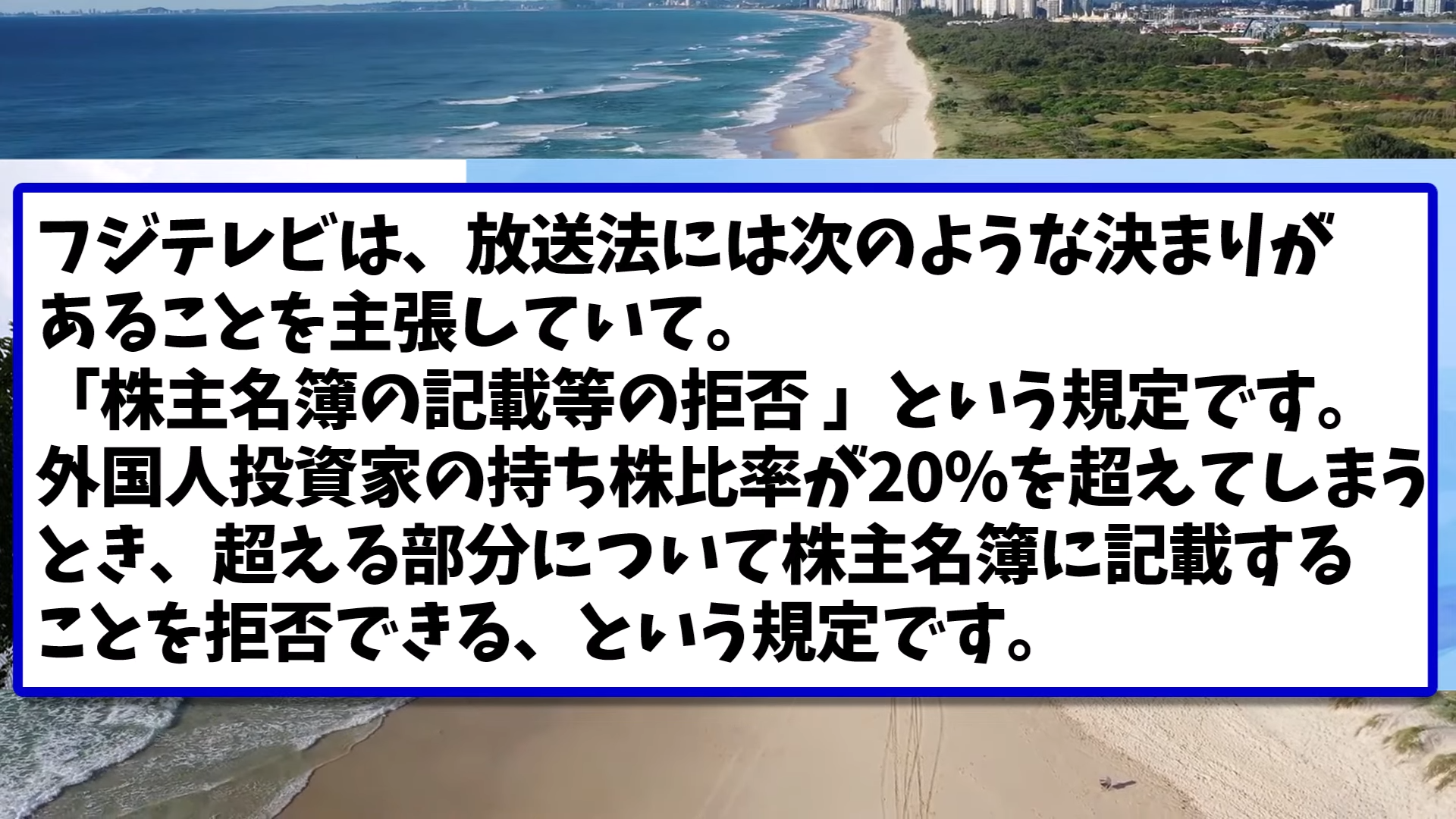

In fact, there is a clause that states that when foreign ownership of a broadcasting company exceeds the 20% limit, the company can “veto” the ownership registration of the foreign ownership that exceeds 20% so that the ratio of voting rights that are foreign-owned becomes less than 20% (the exact regulation is that foreign voting rights must be less than 1/5 of the total). Doing this keeps the broadcasting company’s the ratio of foreign-owned voting rights within regulations.

https://www.youtube.com/watch?v=6RUoWCsfCac

Thus, going back to the images with the two columns, the first column is the ratio of company shares that are foreign-owned and the second column is effectively the ratio of voting rights of that company that are foreign-owned. Thus, Fuji TV at 31.90% and Nippon TV at 23.63% at the top of that chart were not in actually in violation of regulations.

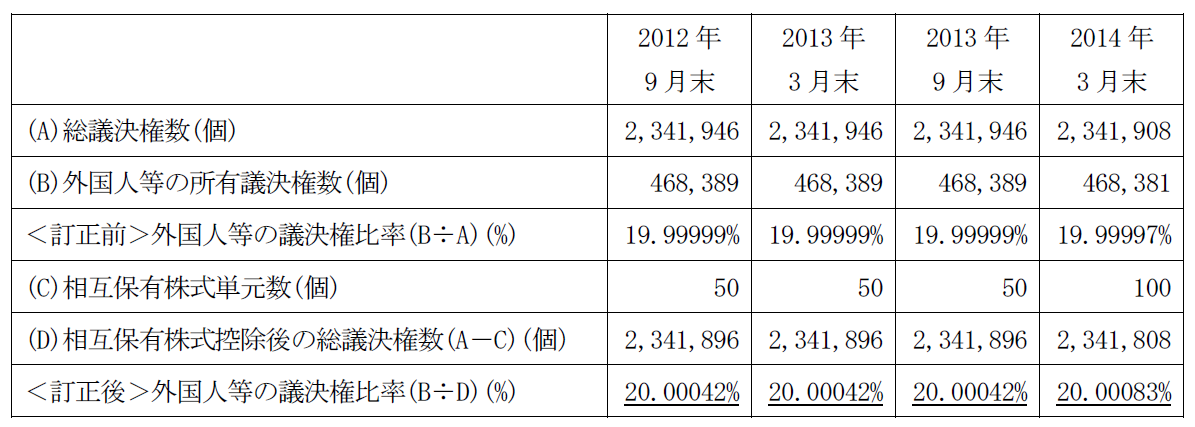

However, in April of 2021, Fuji TV announced that they were in fact in violation of regulations when the ratio of foreign-owned voting rights went up to… 20.00083%. It was, as one might expect from that number, due to inadvertently not excluding enough foreign ownership of shares when it came to registering ownership for the purpose of counting voting rights. The takeaway is that companies, such as Fuji Media Holdings and Nippon Television Holdings (the holding companies of Fuji TV and Nippon TV) in 2021 as the chart above shows, with foreign ownership of shares above 20%, continuously legally exclude a certain amount of foreign ownership when it comes to counting voting rights in order to stay within the regulation of having foreign-owned voting rights be under 20%.

https://av.watch.impress.co.jp/docs/news/1317478.html

https://www.fujimediahd.co.jp/news/

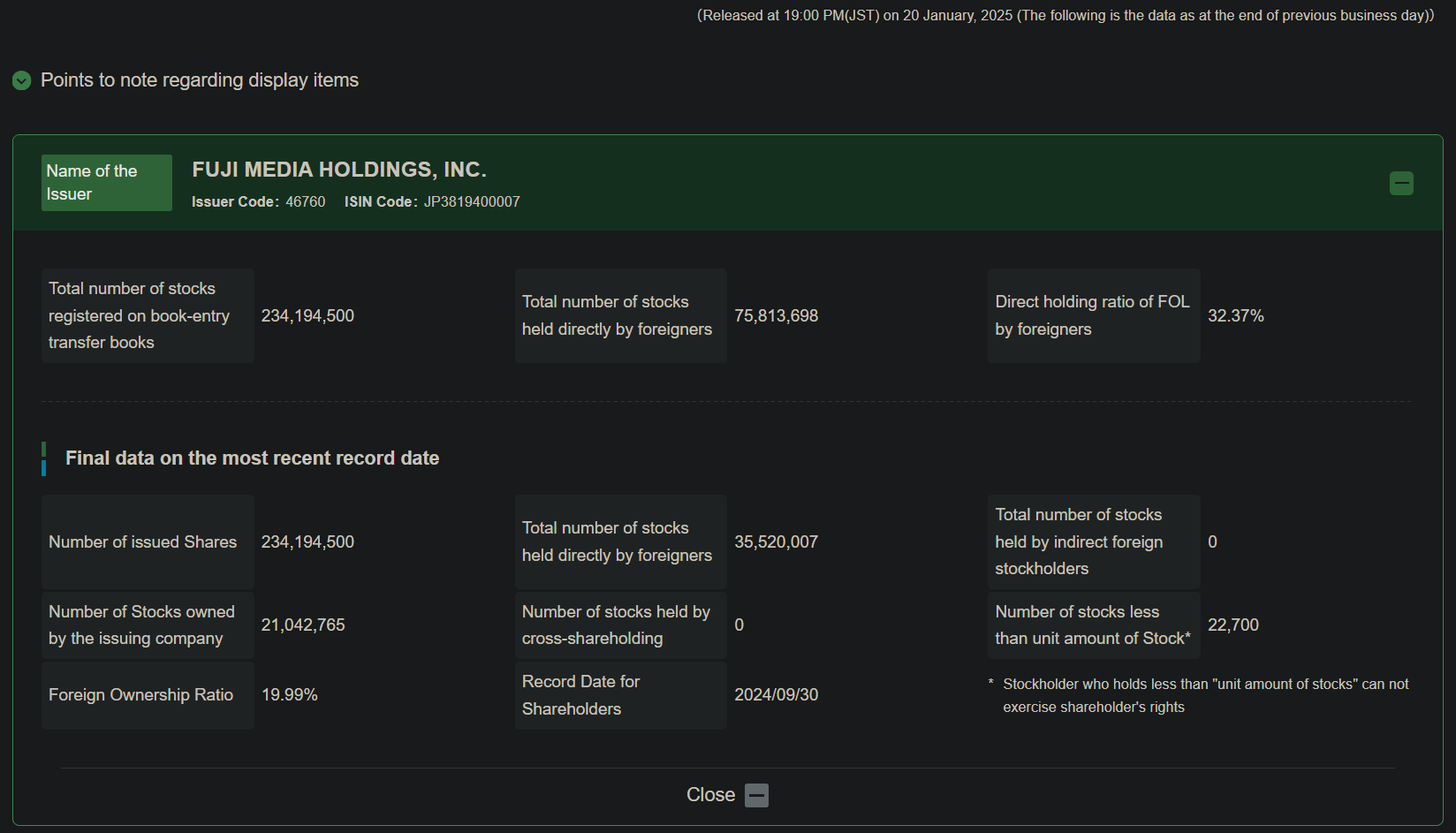

Coming back to 2025, this means that Dalton Investments and Rising Sun Management (plus other foreign investors in total) are free to acquire more shares of Fuji Media Holdings if they believe there is upside to it without any limit, but the total voting power of foreign owners of Fuji Media Holdings will likely remain at 19.99%.

https://www.jasdec.com/description/less/publication_fol/publication_fol.html

https://www.jasdec.com/en/description/less/for_pubinfo/for_pubinfo.html

The above foreign ownership data of Fuji Media Holdings, as can be seen in the upper right of each image, is as of January 20, 2025.

As of January 21, 2025, 75 companies have withdrawn their advertisements from Fuji TV and more than 350 instances of advertisements have been switched to AC Japan public service announcements.

https://www.asahi.com/articles/AST1P4HLFT1PUCVL05BM.html

Archived version of above: https://archive.ph/Hr4A6

Foreign Ownership of Fuji Media Holdings in a Bit More, Bit More Detail

Currently, Dalton Investments owns something like 13,646,800 shares or ~7% of Fuji Media Holdings.

https://www.buffett-code.com/company/4676/mainshareholder/large_volume_trades

But this comes from the actual shares that Dalton Investments (and Rising Sun Management) owns. As was established above, when the foreign ownership ratio of a broadcaster (or a holding company that operates broadcasters) exceeds the legal limit of 20%, the company in question must lower the foreign ownership of voting rights so that that stays within 20%. So what happens, or rather, what happened to Dalton’s 7% ownership, about which Dalton is not shy about reminding Fuji Media Holdings.

Mirror of above pdf letter: FMH-Special-Independent-Committee-English-PffD-version

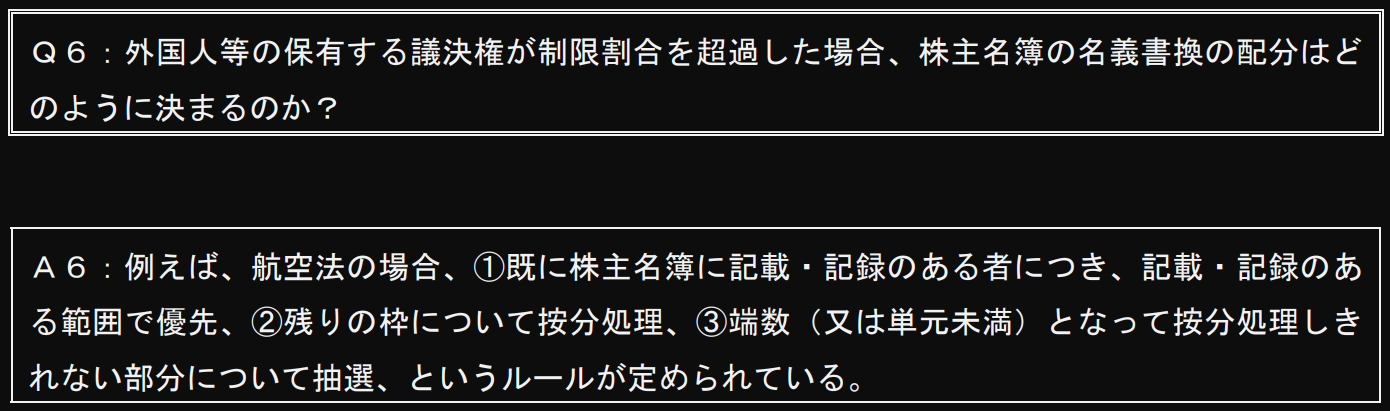

I’m not sure about the exact logistics, but generally speaking, it looks like a combination of: 1. long-time foreign share holders receive some preference, 2. proportional foreign ownership of the legally allowed less than 20% voting rights ratio, 3. lottery for fractions of shares that can’t be reasonably given out.

https://www.dir.co.jp/report/research/law-research/law-others/12100502law-others.pdf

The above image uses the law for airline companies as an example, but the procedure is about the same for the law for broadcasters. Thus, it’s reasonable to assume that Dalton Investments and Rising Sun Management have less than 7% of the total voting rights of Fuji Media Holdings. With Fuji Media Holdings having 32.37% of its shares owned by foreign investors, a simple proportional division of the 19.99% voting rights available to foreign investors means that:

7%/32.37% = X / 19.99%

where X is the percent of voting rights that Dalton Investments and Rising Sun Management hold. X = 4.3%. Perhaps this is why Fuji Media Holdings and Fuji TV management believe that they can hang on: Dalton is loud, but it likely does not have more than 5% of the voting rights of Fuji Media Holdings.

However, with public and corporate sponsor opinion of Fuji TV becoming extremely negative, perhaps other share owners, especially domestic ones, will believe that big changes are needed. Dalton was calling for a break up of the company from before the scandal (the price-to-book ratio of Fuji Media Holdings was 0.4 ~ 0.5, after all). But other shareholders may not go as far as Dalton and instead may believe that a purge of current Fuji executives is enough.

Nakai Masahiro announces his retirement from the entertainment industry on January 23, 2025

https://www.oricon.co.jp/news/2365408/full/

Dalton Investments and Rising Sun Management send a second letter on January 21, 2025 to Fuji Media Holdings since the scandal broke

The letter is strongly worded, to say the least. The tone feels almost political rather than corporate.

They call the January 17 press conference “nothing less than a virtual car crash” and “an object lesson in how not to handle crises like the current one.” “Now, the furore that [Fuji Media Holdings Group’s ‘serious’ corporate governance shortcomings] have caused is clearly not going away.”

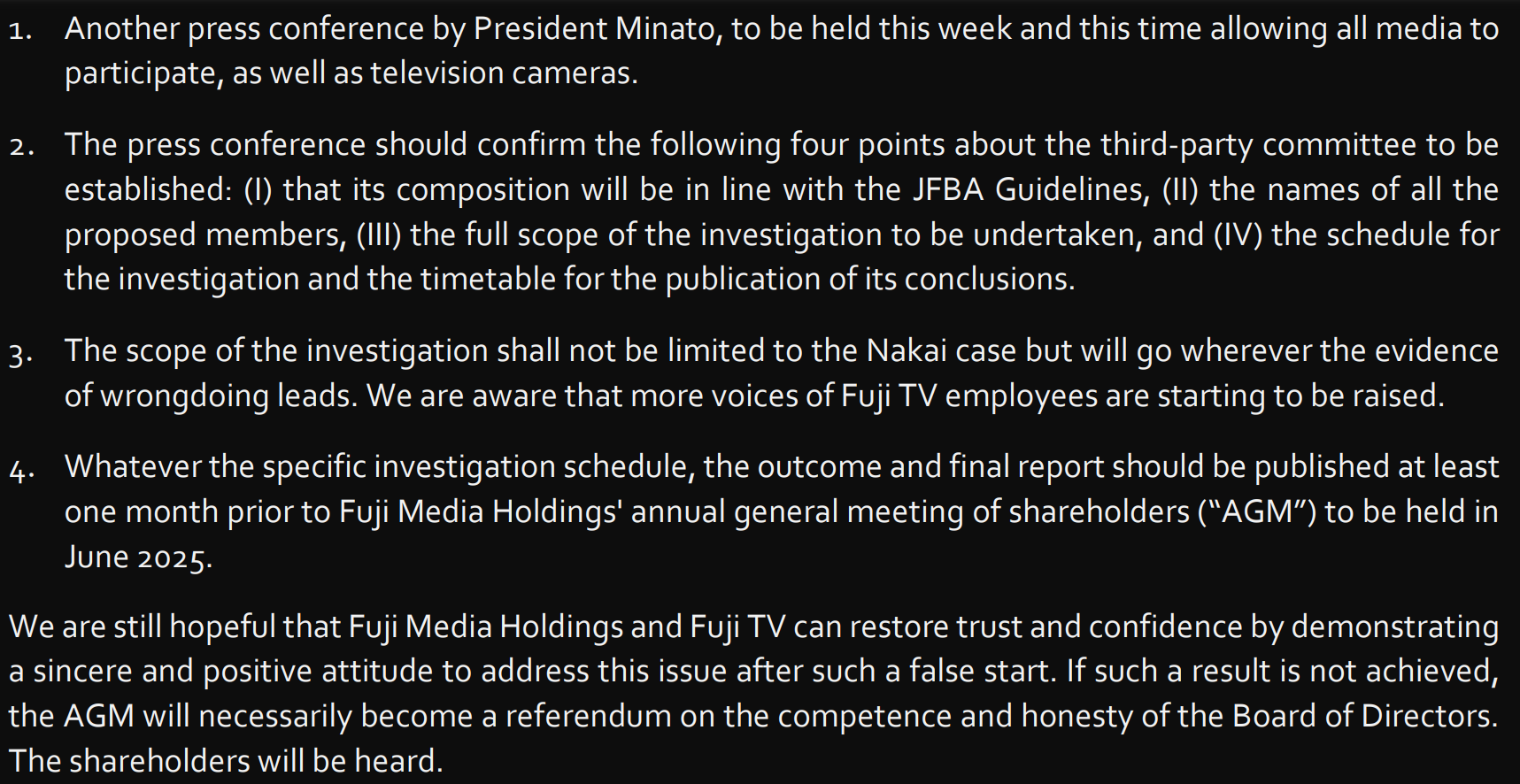

They call for a third party committee that accords with Japan Federation of Bar Association guidelines to conduct the investigation, for President of Fuji TV Minato Koichi to hold a press conference with all media and television cameras allowed within the week, and for the final report by the investigation to be published at least a month before the annual general meeting of shareholders of Fuji Media Holdings in June 2025. They emphasize that the shareholder meeting in June 2025 will be the time when decisions will be made regarding the matter.